The TSR Ratio™

Transparency, Surplus, and Riskier Assets

For seasoned and serious advisors. Introducing a fast and effective way to assess your client’s annuity and life insurance company counterparty risk.

It's no secret

Private equity firms are using increasingly complex financial engineering to discount liabilities and enhance yields on investment strategies that are much less traditional than in the past. They're doing so with dollars placed in insurance products such as annuities and life insurance. As a conscientious advisor, you need a tool that sheds light on this very real and serious risk. This critical three-page report compiled by specialized forensic accountant Tom Gober uses each company’s own annual sworn statement to pinpoint troubled reinsurance and excessive risk issues relative to the company’s stated surplus. The TSR Ratio™ is mathematically represented as follows:

Opaque and affiliated reinsurance + riskier assets (defined by Fed Reserve and NAIC) |

|

= TSR Ratio™ |

|

reported surplus in the company’s most recent annual sworn statement |

The TSR Ratio™ - Embrace Your Comprehensive Fiduciary Duty:

Use The TSR Ratio™ to Mitigate Your RIA & BD Fiduciary Risk and Sole Reliance on Price & Income Quoting from your OID (Outside Insurance Desk).

Recognize that a "Highly Rated" Legal Defense Post SEC Commissioner Jaime Lizarraga Ending Reliance on Credit Ratings for a Fiduciary is very likely a losing defense for selling insurance based products from carriers with thin surplus and easily identified high risk practices taken directly from the carrier's own annual sworn statement(s).

The TSR Ratio™ becomes your alternative standard of creditworthiness credit risk model, per SEC Commissioner Lizarraga guidance in his June 7, 2023 statement: https://www.sec.gov/news/statement/lizarraga-statement-credit-ratings-060723

ATTENTION PENSION PLAN ADVISORS AND CONSULTANTS: The TSR can prepare your plans for the re-interpretation of ERISA IB 95-1.

Unlike other services, the available TSR Institutional Reporting is Specific to your client's plan. As such, this approach makes the reporting a plan billable expense. Plus, all of your annual membership fee is credited against your first institutional report expense.

Tom Gober

For 35 years Tom has been fighting to protect insurance policyholders. His policyholder protection expertise runs the gamut of insurance operations - primarily insurance company failures to act in good faith, including claims delays or denials, false advertising, and misrepresentation of policy benefits.

Most recently, Mr. Gober has exposed a significant increase in false financial reporting to disguise their hazardous financial condition. Mr. Gober serves some of the most respected attorneys in the country helping policyholders find justice.

Why do top financial advisors, insurance agents, CPAs, and lawyers need to listen to Tom Gober, especially now?

Tom is the expert that law enforcement relied on for education and consultation with agents to prove fraud in the AIG criminal case. He is also a former regulator in a state where his last official act was to get his boss’s wealthy friends jailed for insurance fraud. Tom is a champion to the policyholder and a true believer in the benefits of life insurance and annuities.

When insurance companies do it right and are respectful of their policyholders’ money, life insurance and annuities play a vital role in a solid financial plan.

Tom is the go-to expert for top lawyers, the financial media, and law enforcement when life insurance and annuity companies have balance-sheet issues that require expert investigation for fraud and wrongdoing. His work has been done in the courtroom, in the field undercover, and reported widely in the financial media.

Want a sample TSR report?

Get TSR Report Now

The TSR Ratio™ was created when Tom Gober and Matt Zagula, the founder of the SMART Advisor Network and a known advocate and product developer for mutual and fraternal companies, joined forces to expose troubling risk-shifting and aggressive asset-purchasing patterns as they became more common from stock-owned insurance companies and even more so from private equity-owned insurance companies.

Together, Tom and Matt identified what they believed to be the most significant counterparty risk areas: affiliated and opaque reinsurance and excessive high risk (and illiquid) assets, as defined by the Federal Reserve and NAIC, in comparison to the insurance companies' reported surplus in their annual sworn statements.

What does the TSR Ratio™ have that rating agencies and the regulators don't?

Rating agencies are focused on assets

Rating agencies give very little attention to the substance of reinsurance or the excessive buying of affiliated assets in comparison to the insurance company's surplus. Often, the ratio of high-risk assets to the total assets is considered. From a policyholder view, the more important consideration is high-risk assets compared to the financial cushion: the insurance company's stated surplus. Tom says, "Rating agencies have an asset rating heritage in their core DNA."

State insurance regulators focus

on reviewing external audit workpapers

Regulators review admitted carriers' audit firm reporting. Examiners do desk analysis every three to five years in a face-to-face exam at the insurance company. This limits their review to the data presented by the auditing firm who was hired by the insurance company. Tom, a former regulator, says, "The NAIC permits audit firm reliance in the review process."

What you get as a TSR Ratio™ Subscriber

A detailed, three-page report

identifying the higher-risk assets and opaque nontraditional reinsurance as a ratio to the reported surplus. REMEMBER: All data comes from the insurance companies’ annual sworn statements. This is a mathematically determined ratio devoid of opinion.

A continuum for carrier comparisons

so subscribers can quickly contrast the difference between two very different companies—from more traditional to less traditional but more financially engineered insurance companies.

Got questions?

Here are the answers to those we are most frequently asked:

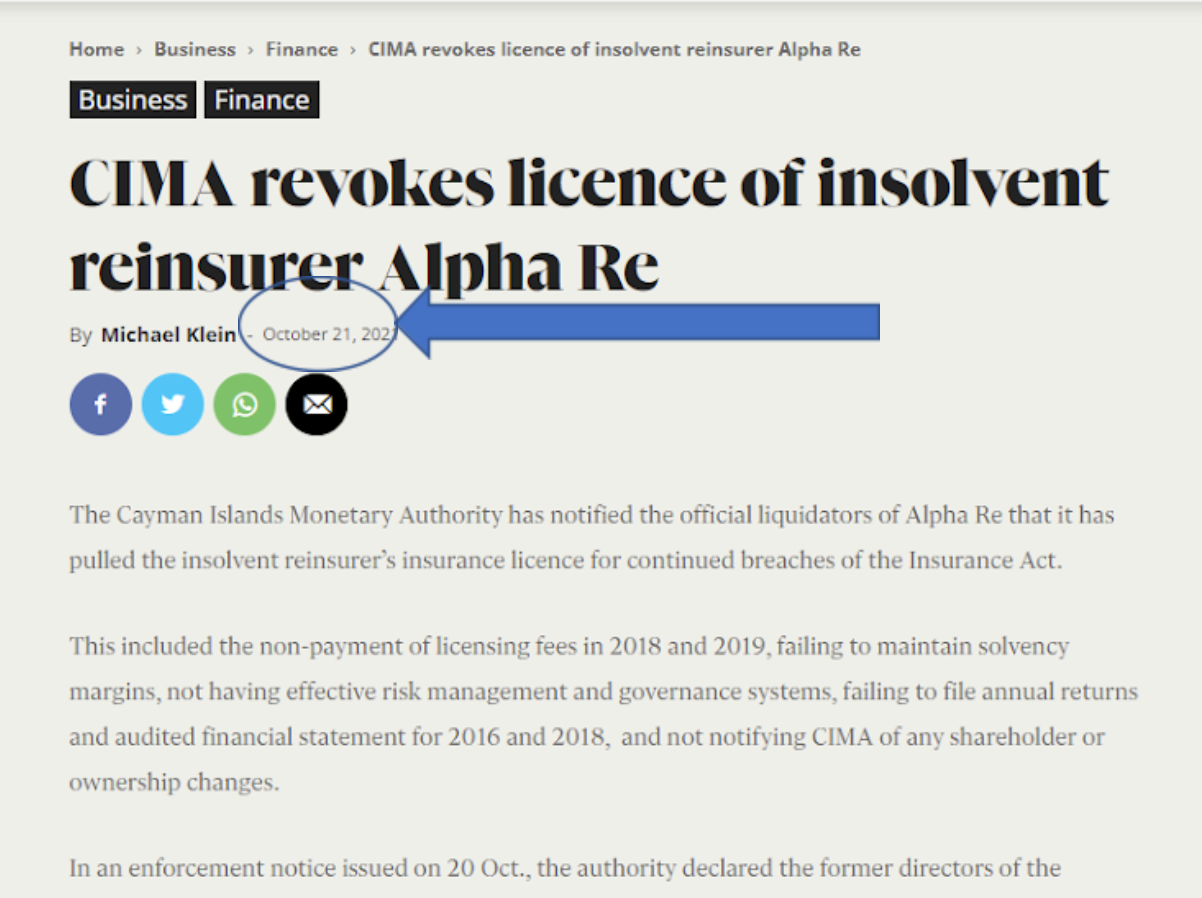

Take a look for yourself at a recent article discussing the license revocation of insolvent reinsurer, Alpha Re. Opaque reinsurance is an enormous problem. You need to be aware of this as markets continue to rise, inflation continues to present higher, less liquid assets, and risk-shifting financial engineering presents a real and immediate issue.

This is equivalent to what frequent customers of Starbucks spend on lattes, muffins, and coffee each year. It’ll renew annually unless you request otherwise.

Todd Allen, Retirement Planner, South Carolina